Holding & Projects

Projects of the future and sustainble portfolio management

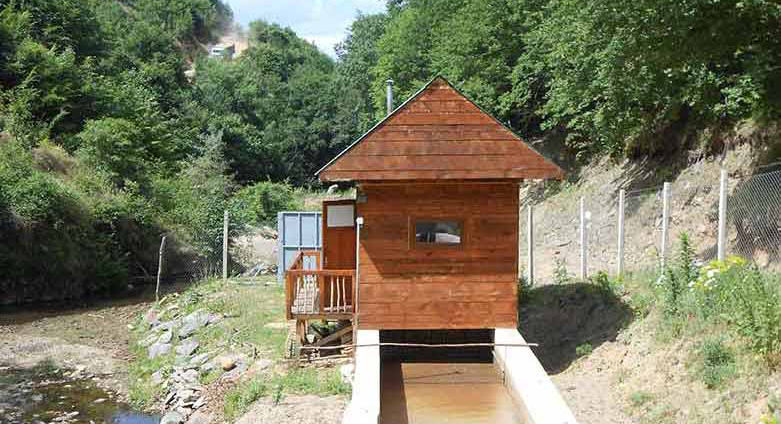

The Holding & Projects segment manages and controls projects aligned to the future, for example a production plant for oxyalkylates in Malaysia which we operate together with our joint venture partner PETRONAS Chemicals Group Berhad (PCG); another plant in the USA is in the planning phase. In this segment we also run our startup PCC Thorion GmbH, which is developing an innovative material made from nano-silicon powder to increase the performance of lithium-ion batteries. The basis of this innovation is our “green silicon metal”, which we produce in Iceland in a climate-friendly manner. The segment is divided into the two business areas Investment Management and Projects. In the Projects business area, we also manage our environmentally friendly small hydroelectric power plants and project companies in the renewable energies business area.

Projects

Here are some examples of project management in the Holding Projects segment:

Production of Alkoxylates in Malaysia

PCC SE and PETRONAS Chemicals Group Berhad (PCG) have established a production facility for alkoxylates (special polyether polyols and non-ionic surfactants) in Kerteh in the Malaysian state of Terengganu. With this investment project, the PCC Group is expanding several of its core business areas into the growth regions of Southeast Asia and Asia-Pacific.

Project for an innovation in more efficient lithium-ion batteries in Germany

Our startup PCC Thorion GmbH is developing a composite material made of silicon and carbon to improve the performance of lithium-ion batteries in collaboration with Fraunhofer ISE. As an anode active material, this high-tech component offers several times higher energy density than the commonly used graphite and therefore significantly increases the capacity of lithium-ion batteries.

Set up of oxyalkylates production in the USA

PCC is planning to establish an alkoxylate production facility in the USA to further advance the expansion of the PCC Group’s core business areas in the important US market. A potential location is in Bay City, Matagorda County, Texas, on the Gulf of Mexico. On September 15, 2023, the project company PCC Chemicals Corporation signed a terminable lease agreement with the Port of Bay City for a property in close proximity to the local port.

Construction of a chlor-alkali plant in the USA

PCC is planning the construction and operation of a chlor-alkali plant on the site of Chemours’ (NYSE: CC) titanium dioxide (TiO2) plant in DeLisle, Mississippi (USA). Construction is scheduled to begin in early 2026, with the plant expected to be operational in 2028.

Portfolio Management

The active portfolio management approach of PCC SE encompasses, firstly, the development of our operations and affiliates, and secondly, utilization of divestment opportunities. Our focus with regard to the development of operations is aligned in equal measure to the acquisition of new shareholdings and the leveraging of existing activities and projects. We are primarily concerned with positioning ourselves in less competitive submarkets and market niches. Our main investment engagement continues to be directed towards the developing economies of Central, Eastern and South-East Europe, although we are stepping up our activities in emerging markets on other continents, particularly Asia.

As indicated, however, PCC is also willing and able to sell operations and affiliates where disposal offers attractive gains and the funds thus released can be invested in the expansion of other core activities. The holding company will also dispose of portfolio entities where these are unable to offer satisfactory returns or fail to exhibit attractive development potential.

The following offers examples of the approach to portfolio management adopted by PCC SE:

Telecommunication and data center activities

Until June 2015, the company 3Services Factory S.A., the activities of which include operation of a data center, was allocated to the Projects business unit. In 2014, the data centre underwent its third expansion phase, achieving a significant increase in both sales and profits compared to the previous year. However, this company lies outside the core business activities of the PCC Group, and PCC SE therefore decided to dispose both of this participation and also of its minority shareholding in 3Services S.A., Katowice, the co-owner of the data centre. The closing of the sale took place as planned at the end of June 2015. This constitutes a further example of the strategy of active portfolio management adopted by PCC SE, whereby projects are developed to the point where they can also be sold on to other investors.

Listing of PCC Rokita SA

Sale of shares in PCC Exol SA

Expansion of the PCC Consumer Products subgroup

Sale of PCC Logistics to Deutsche Bahn AG

In July 2009, PCC SE completes the sale of its Polish railway activities, the ‘PCC Logistics’ group of companies, to Deutsche Bahn AG. With this sale, PCC records the biggest success to date in its active investment portfolio management. Not included in the sale is PCC SE’s majority stake in PCC Intermodal SA, which operates in the dynamically growing Polish container transport market and continues to be expanded in the following years.

Our small hydropower plants in the renewable energy sector

Investments in the Holding Projects segment